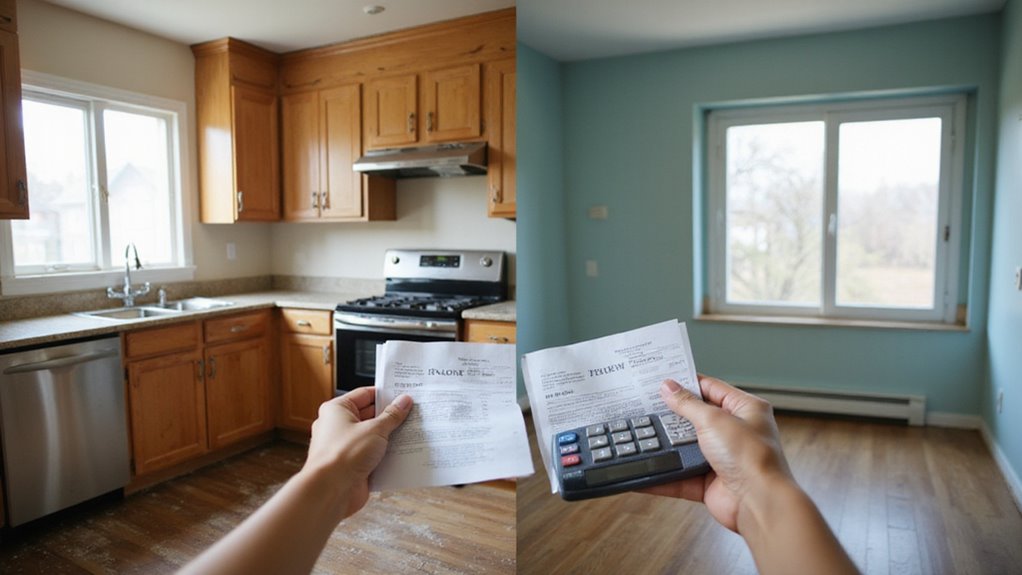

Hidden costs lurk around every corner when homeowners embark on their home-selling journey. Many sellers face unexpected financial burdens that eat into their profits during the selling process. These surprise expenses can derail budgets and create stress during an already challenging time. Smart planning and knowing all costs beforehand helps sellers protect their investment and maximize their returns.

The main costs of selling a house include realtor commissions (5-6%), closing fees, repairs, staging, and marketing expenses. Additionally, sellers must continue paying mortgage payments, property taxes, utilities, and maintenance until the sale closes. Cash buyers eliminate many traditional costs like commissions and repairs.

In this guide, we will explore every expense you might encounter when selling your home.

The main costs of selling a house come from real estate agent commissions and closing fees. A standard real estate commission ranges from 5 to 6 percent of the final sale price. Most closing costs include title insurance, escrow charges, and recording fees.

Homeowners must also cover repairs and staging expenses before listing. In addition, sellers remain responsible for utilities, property taxes, and HOA dues until closing day.

These extra costs typically total 1 to 2 percent of the sale price. Smart planning helps avoid financial surprises during the sale process.

Realtor commissions typically cost sellers 5-6% of their home’s final sale price. This substantial fee reduces the actual profit from your home sale. The commission gets split between the listing agent and buyer’s agent at closing.

Sellers can negotiate lower commission rates with their agents to keep more proceeds. Alternative options like flat-fee brokers or discount agents offer reduced costs. A $400,000 home sale with a 6% commission means paying $24,000 in agent fees.

Furthermore, savvy sellers often compare different agents’ commission structures before listing. Smart negotiation and careful agent selection help preserve more equity from the sale.

As a seller, you’ll encounter several closing costs, including title insurance fees, escrow or attorney fees, and recording charges.

You may also need to pay off your mortgage and possible prepayment penalties. Understanding these expenses helps you prepare for the total costs at closing.

Title insurance fees protect buyers and lenders from future property ownership disputes. These fees typically range from 0.5% to 1% of the purchase price for a standard policy.

The seller usually pays for the owner’s title insurance policy in most US states. The exact cost depends on property location and local insurance providers. Legal expenses and title search fees may add to the total amount.

Some states require both owner’s and lender’s policies for real estate transactions. A clear sales contract should specify who pays these insurance costs.

The agreement helps prevent misunderstandings between buyers and sellers during closing. Additionally, title insurance offers lasting protection against hidden claims or property defects.

Escrow fees range from $500 to $2,000, while attorney fees can cost $500 to $1,500 for home sales. Escrow fees pay for third-party services to manage the financial transaction and paperwork securely.

In Oregon, escrow companies typically handle closings without requiring an attorney. Legal review remains optional but provides extra protection for complex transactions or unique circumstances.

Buyers and sellers can negotiate the responsibility for these fees during the sale. Most purchase agreements specify how closing costs split between both parties.

Transfer taxes don’t exist at the state level in Oregon. Counties require recording fees between $100 and $200 for property transfers.

Public records must reflect accurate ownership details after each sale. Local county offices handle all documentation requirements for real estate transactions. The recorder’s office maintains official property records.

Before closing, smart sellers contact their county office to verify exact fee amounts. These small administrative costs ensure proper legal documentation of the ownership change. Property buyers and sellers split recording fees according to their sales agreement.

A mortgage payoff requires paying your remaining loan balance when selling your home. The final amount includes current principal, interest, and potential penalty fees.

Prepayment penalties can add 2-5% to your payoff total if you settle the loan early. The best approach starts with reviewing your loan agreement carefully. Contact your lender for an official payoff statement. Request this document at least 10-15 days before closing.

Moreover, understanding these costs helps prevent closing process. Loans without prepayment penalties save money and offer more flexibility for early payoff. Your closing agent will ensure proper payment of the exact amount.

Prioritize repairs that ensure safety and structural integrity, like fixing roofs, plumbing, or electrical issues, as they can prevent costly problems during inspection.

Cosmetic updates such as fresh paint or landscaping often yield high returns on investment and improve curb appeal. Consider a pre-listing inspection to identify hidden issues early, saving you surprises and negotiation headaches later.

Structural and safety repairs are vital fixes needed before selling a home. A property must have sound foundations, roofing, electrical systems, and working HVAC equipment.

Major repairs typically include fixing foundation cracks, updating old wiring, repairing roof leaks, and replacing faulty plumbing.

These essential updates protect both sellers and buyers from future problems. Quick fixes now prevent costly negotiations or failed sales later.

Moreover, properly maintained homes attract serious buyers and command better prices. Most importantly, critical repairs ensure occupant safety and meet local building codes. Professional contractors should handle complex structural and safety improvements.

Paint, updated fixtures, and basic landscaping deliver the highest return on cosmetic home improvements. A fresh coat of paint can recoup 107% of its cost at resale.

New cabinet hardware and light fixtures typically return 80-90% of the investment. Simple exterior updates create powerful curb appeal that attracts buyers immediately.

Clean landscaping, pressure-washed surfaces, and trimmed shrubs signal a well-maintained property. Smart cosmetic changes help homes sell faster without expensive renovations.

Minor updates under $5,000 often return more value than major remodels costing $50,000+. The key is choosing improvements that enhance visual appeal while keeping costs reasonable.

Pre-listing home inspections cost between $300 to $500 for an average single-family house. The final price depends on your location and property size.

Professional inspectors examine your home’s major systems and structures before listing. A detailed report helps you address issues proactively and set accurate pricing. This investment prevents costly surprises during buyer negotiations.

Smart sellers use inspection findings to make strategic repairs that boost home value. Most inspectors complete their assessment within 2-3 hours and deliver reports within 24 hours. As a result, the selling process becomes more transparent and efficient.

Staging and marketing expenses can significantly affect your selling costs. You might spend $500 to $2,000 on professional staging, plus $150 to $500 on photography and virtual tours. Additional marketing fees vary by agent but are essential to attract buyers quickly.

Professional home staging costs between $500 to $5,000 for most homes. The final price depends on the property size and required services. A basic staging package includes furniture rental and decor placement for key rooms.

Additional marketing expenses include professional photography ($150-$500) and virtual tours ($100-$300). These services create a strong first impression for potential buyers.

Furthermore, the investment in professional staging often leads to faster sales and better offers. Many staged homes sell for up to 10% more than non-staged properties.

Professional photos and virtual tours cost between $250-800 total for most home listings. A professional photographer charges $150-500 for a complete set of high-quality listing photos. These images capture your home’s best features in optimal lighting. The photos help attract serious buyers and generate strong interest.

Virtual tour services range from $100-300 depending on home size and tour features. A virtual walkthrough allows remote buyers to explore the property thoroughly online. Moreover, this technology reduces wasted showings and helps find committed buyers faster.

Advertising and marketing fees typically range from $200 to $2,000 when selling a home. The exact amount depends on your location, property value, and chosen marketing channels.

Professional photos cost $150 to $300 for a standard home shoot. Virtual tours add another $200 to $400 to showcase your property online.

Print materials like signs, flyers, and brochures run $100 to $300. In addition to these basics, social media advertising costs $100 to $500 per campaign. Most sellers achieve good exposure with a $500 to $1,000 total marketing budget.

Many sellers overlook ongoing costs like property taxes, utilities, and HOA fees during the selling process. Moving expenses can also add up quickly, often catching you off guard. Additionally, consider possible capital gains taxes and seller concessions, which can impact your net proceeds significantly.

Common expenses continue during a home’s selling period. Property taxes, utilities, insurance, and HOA fees must be paid until closing day. A seller typically spends $2,000-5,000 on maintenance, inspections, and repairs.

Extra costs often emerge from home staging, temporary storage needs, and property upkeep. Smart budgeting helps protect profit margins. Moreover, most sellers need to maintain landscaping and basic services.

The average homeowner faces monthly carrying costs of $800-1,500 while their property remains on the market. Therefore, a quick sale helps minimize these ongoing expenses.

Moving costs typically range from $1,200 to $5,000 for a local move and $5,000 to $8,000 for long-distance relocations. The total depends on distance, home size, and services needed.

Basic expenses include boxes, packing tape, bubble wrap, and professional movers. Additional fees come from truck rental, fuel costs, and temporary storage units.

To reduce these costs, request free boxes from local stores. Smart sellers negotiate moving cost credits into their contracts with buyers. A well-planned budget and timeline help prevent unexpected financial strain during relocation.

Capital gains tax affects your profit when selling property. The IRS allows single homeowners to exclude up to $250,000 in gains, while married couples can exclude up to $500,000.

These exclusions apply only if you owned and lived in the home for at least 2 of the last 5 years. Furthermore, proper documentation of home improvements can increase your cost basis and reduce taxable gains.

Each state has different tax rates on real estate transactions. To minimize tax impact, keep detailed records of all home-related expenses. A qualified tax professional can help calculate exact obligations and identify potential deductions.

Seller concessions are payments sellers make to cover some of a buyer’s closing costs. Sellers can offer up to 6% of the home’s purchase price in most conventional loans. A seller might pay for home inspections, title insurance, or loan origination fees.

These concessions make properties more appealing to potential buyers with limited funds. Therefore, sellers should factor these costs into their pricing strategy. Smart concession planning helps create win-win deals. Sellers can maintain their target profit while buyers receive valuable financial assistance.

Selling to cash buyers can eliminate realtor commissions, saving you thousands. It often leads to lower closing costs and removes the need for repairs or staging. Plus, a faster sale reduces holding costs and streamlines your move.

Commission fees vanish completely when selling to cash buyers. A direct cash sale eliminates the standard 5-6% realtor fees from your total costs. Traditional real estate commissions range from $15,000 to $30,000 on a $300,000 home.

Moreover, cash transactions bypass additional broker charges and service fees. Professional investors cover their own closing costs and paperwork expenses.

Your final sale price becomes your actual profit. As a result, homeowners keep more money from their property sale. Simple transactions create clear financial outcomes without surprise deductions or markups.

Cash buyers reduce closing costs by eliminating traditional transaction fees. Typical savings on closing costs range from 2% to 5% of the sale price.

These buyers skip lender-required inspections and appraisals. The process cuts out mortgage-related expenses like escrow fees and transfer taxes. A faster timeline means lower carrying costs for sellers. Buyers benefit from quick, straightforward transactions.

Moreover, no loan requirements mean fewer document preparation fees. Cash transactions often close within 7 to 14 days instead of 30 to 45 days with traditional financing. Smart sellers should compare multiple cash offers to maximize savings.

Cash buyers purchase homes without requiring sellers to make repairs or stage the property. The sale happens in “as-is” condition, saving significant money upfront. Sellers avoid typical repair costs of $5,000 to $15,000 for fixes like roofing, plumbing, or electrical work.

Additional savings include $1,500 to $3,500 for professional staging services. Homeowners also skip inspection-related repairs and marketing expenses.

Moreover, the straightforward process eliminates the need for cosmetic improvements or landscaping. A clean, simple transaction benefits both parties with reduced costs and faster closing times.

Cash buyers save you money by closing deals faster than traditional buyers. A cash sale takes just 7-14 days versus 30-60 days for conventional sales. Quick closings reduce ongoing expenses for utilities, taxes, and insurance. Your property spends less time on the market.

Cash transactions remove common delays from inspections and bank approvals. Moreover, you avoid costly repair negotiations and appraisal issues. As a result, the entire process becomes more streamlined and cost-effective. The simplified timeline cuts carrying costs by up to 75% compared to traditional sales.

Understanding these costs helps homeowners make informed decisions when selling their properties in Eugene and Springfield. We at OR Home Buyers recognize the importance of transparency in real estate transactions. Our team guides sellers through every expense, ensuring they receive fair value for their homes.

As a trusted house-buying company in Oregon, we serve communities from Cottage Grove to Junction City with professional service. We eliminate many traditional selling costs by offering direct purchases without real estate commissions. Our straightforward process helps homeowners avoid unexpected fees and lengthy negotiations.

OR Home Buyers provides solutions for homeowners across the Willamette Valley, including Salem and nearby areas. We understand the local market conditions and offer competitive prices based on current trends. Our commitment ensures sellers receive the best possible outcome while maintaining complete control of their timeline.

Hi, I’m Bob Bash, founder of OR Home Buyers, serving the Oregon community since 2017. We provide full-service real estate solutions, specializing in cash purchases for both residential and commercial properties. I started this business to help our community navigate difficult real estate situations with professionalism, ethics, and compassion.

My goal is simple: to make every client feel relieved and happy when their real estate challenges are resolved. Helping people find solutions and peace of mind is what drives me every day.

Sell Your Oregon Home Quickly. Receive a fair cash offer within 24 hours. We buy homes as-is, including complex titles, estates, and foreclosures. No repairs, no fees, no stress. A simple solution for a fast, flexible closing.

590 Pearl St suite 317, Eugene, OR 97401

@ 2024 OR Home Buyers. All Right Reserved