Drowning in paperwork while trying to sell your loved one’s property feels overwhelming. Navigating the maze of legal requirements during an already emotional time creates unnecessary stress and confusion. Our comprehensive guide simplifies the process so you can complete the sale with confidence and peace of mind.

Selling inherited property requires several essential documents including death certificates, property deeds, and probate documentation that establishes your legal right to sell. You’ll also need to address any outstanding liens, secure clear title, and prepare proper tax documentation including basis valuation and required IRS forms. In this blog I will explore everything about documents needed when selling inherited property.

In this blog I’ll explore documents required for selling an inherited property.

Essential documents for selling inherited property include the death certificate and property deed. The death certificate proves the previous owner has passed away. A property deed confirms legal ownership of the real estate.

You must also have the will or trust paperwork that names you as the inheritor. Letters of testamentary or administration from probate court may be required. These documents establish your legal right to sell.

In addition, mortgage statements and tax records help clarify any outstanding obligations. Clear documentation prevents delays and disputes during the sale process.

Proper documentation proves your legal right to sell inherited property and prevents potential disputes. A valid will, probate papers, and death certificate establish your ownership authority. These documents protect you from claims by other heirs or creditors.

Clear ownership records ensure legal compliance during the sale process. State laws require specific documentation for inherited property transfers. The probate court validates your right to sell through official paperwork.

Documentation also streamlines the selling process for buyers and their lenders. In addition, proper paperwork protects you from future liability claims after the sale concludes.

Most importantly, thorough documentation gives you peace of mind throughout this potentially emotional transaction.

To prove your inheritance rights when selling inherited property, you’ll need specific legal documents.

A death certificate confirms the owner’s passing, while will or probate documents establish your authority to act.

Depending on the situation, Letters of Testamentary or Administration are required to show you can legally handle the estate.

You need multiple certified copies of a death certificate when selling inherited property. These documents prove the previous owner’s death and validate your right to sell.

Request at least 5-10 copies from your local vital records office or funeral home. Each copy must be certified with official seals.

Financial institutions, title companies, and probate courts will require original certified copies, not photocopies. Most counties charge $10-25 per certified copy.

Remember to verify all information is correct before submitting the certificate. Any errors could delay your property sale significantly.

The death certificate serves as foundational evidence for your inheritance claim.

You need specific legal documents to prove inheritance rights. For estates with a will, obtain the original or a certified copy. The probate court must also issue letters testamentary.

Without a will, you must secure Letters of Administration instead. These essential papers verify the executor’s legal authority.

The right documentation prevents delays when selling inherited property. Proper paperwork establishes your legal standing to potential buyers.

Additionally, it smooths the transfer process with title companies and tax authorities. Most states require these documents before allowing property transfers from deceased owners.

You need Letters of Testamentary or Administration to sell inherited property in Oregon.

These court documents prove your legal authority as executor or administrator.

The probate court issues these essential papers after confirming your role in the estate.

Title companies and real estate professionals require certified copies for any transaction.

Before selling inherited property, you must file a petition with the court and notify all heirs and creditors.

This notification process protects everyone’s legal interests. The documents establish your right to manage and transfer the deceased’s assets.

Most county courts provide standardized forms to simplify the application process.

To obtain clear title for an inherited property, you need to start with a thorough title search to uncover any liens or claims.

Next, you must resolve any outstanding debts or encumbrances, like unpaid taxes or mortgages.

Finally, securing title insurance and addressing any clouded issues ensures a smooth transfer of ownership.

A title search verifies ownership history and reveals potential problems with your inherited property. You can access public records at your county recorder’s office or hire a title company. The search examines the property deed to confirm rightful ownership and uncover any existing claims.

Most states require title searches before property transfers can be completed legally.

For best results, professional title searchers can identify issues that might escape untrained eyes. Additionally, they check for liens, easements, and encumbrances.

You must settle all liens before you can get clear property title. Check the deceased’s records for debts like mortgages and tax obligations.

Contact each creditor to verify payoff amounts. Make payments to satisfy these debts.

Next, request lien release documents from each creditor after payment. These papers prove the debts are satisfied.

County offices require these releases to officially clear the property title. Take the releases to your local recorder’s office.

The recorder will update public records to show the property is free of claims. This process protects you from future liability related to old debts.

Title insurance protects your inherited property from ownership claims. You need to complete several key steps for proper coverage. First, request a title search to uncover any liens or claims against the property.

Next, collect required documents including the deed, death certificate, and probate papers.

Select a reliable title insurance company with positive reviews and experience. The company will verify your legal ownership status and issue a policy that shields you from future disputes. This protection remains valid as long as you own the property.

The modest one-time fee provides lasting peace of mind against potential title problems.

Clear title issues by taking immediate steps when documentation problems arise. Start with a comprehensive title search to find any existing claims or liens.

Legal options include filing a quiet title action in court or submitting an affidavit of heirship. These methods officially establish your ownership rights.

Furthermore, consulting with a real estate attorney specializes in inheritance matters can prevent future complications.

Professional help often saves time and money in the long run. In most cases, resolving title problems early prevents more expensive legal battles later.

When selling inherited real estate, you need specific tax documents to comply with IRS and state requirements.

You’ll want proof of the property’s stepped-up basis, such as an appraisal, and completed capital gains tax forms like IRS Form 8949 and Schedule D.

Additionally, if applicable, you may need to submit estate tax returns, like Form 706, for estates exceeding the exemption limit.

The fair market value of inherited property becomes your new tax basis. This reduces potential capital gains tax when you sell. Obtain a professional appraisal within six months of the death date.

Keep all relevant documentation in your permanent records. Original purchase information and improvement receipts can provide valuable context for the appraiser.

Additionally, photographs of the property condition help substantiate the valuation.

For best results, work with tax professionals familiar with estate matters. IRS rules require sufficient documentation to support the stepped-up basis claimed on your tax return. This preparation now prevents potential tax disputes later.

You need Form 8949 and Schedule D to report capital gains from inherited property sales. Form 8949 lists the transaction details. Schedule D summarizes your total gains or losses.

Estates valued over $1 million may require an estate tax return. Documentation of the stepped-up basis is essential for accurate reporting. The stepped-up basis typically reflects the property’s fair market value at the time of inheritance.

This paperwork helps ensure you don’t overpay on your capital gains tax. Furthermore, keeping detailed records of any improvements made to the property can affect your final tax liability.

Estate taxes matter when selling inherited property. Federal estate tax applies to estates worth over $13.99 million.

Some states impose their own inheritance taxes with different thresholds. You’ll need to file Form 706 for large estates.

Keep detailed records of the property’s value at the time of death. These documents determine your capital gains tax liability.

State tax laws vary significantly, so check local requirements before selling. Additionally, the stepped-up basis rule often benefits heirs by reducing potential capital gains.

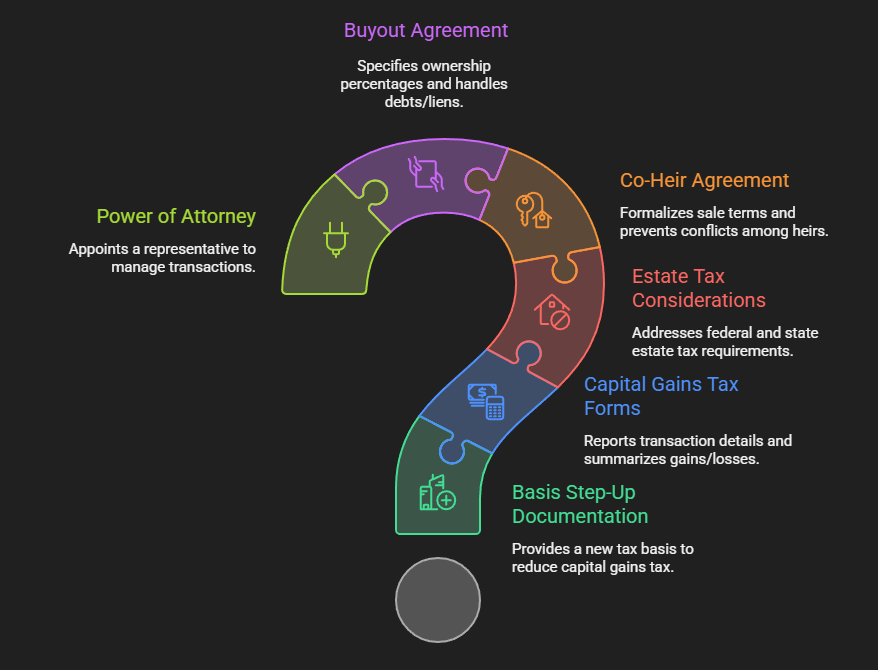

When multiple heirs are involved, the documentation process becomes more complex because all heirs must agree on the sale, often requiring co-heir agreements or buyout arrangements.

You may also need to obtain power of attorney if an heir can’t participate directly.

These additional steps can slow down the sale and increase the paperwork you need to handle.

A co-heir agreement protects all parties when selling inherited property. All heirs must sign this document to formalize sale terms. This prevents future conflicts and ensures everyone understands their rights.

The agreement must specify each heir’s responsibilities and how profits will be divided after the sale. This clarity prevents misunderstandings later.

Your agreement works alongside Letters Testamentary to establish legal authority. Additionally, courts and buyers will recognize this documentation immediately.

As a result, the probate process moves faster with fewer legal hurdles. Most importantly, a proper agreement prevents family disputes that often arise during property sales.

A buyout agreement is a legal document needed when heirs want to sell inherited property. This written contract requires signatures from all parties involved.

The agreement must clearly state each heir’s ownership percentage and specify the property valuation method. It should also address how to handle any existing debts or liens on the property.

With these elements in place, all heirs formally consent to the sale terms. Furthermore, this documentation prevents future disputes among family members. The legal clarity it provides helps streamline the entire property transfer process.

Yes, multiple heirs can complicate the power of attorney process. Too many decision-makers often create conflicts and delays.

To simplify matters, first obtain a legal heir certificate. This document clearly establishes ownership rights among all parties.

Next, have all heirs sign a single power of attorney document. Oregon law requires proper documentation when multiple heirs are involved in property transactions.

Clear communication prevents future disputes. Regular updates keep everyone informed about important decisions.

Consider appointing one trusted representative to handle day-to-day matters. Professional legal guidance ensures compliance with state requirements and protects everyone’s interests.

You may need to provide property tax clearance certificates to show all taxes are paid up before the sale.

HOA documentation might also be required to prove compliance with fees and rules.

Additionally, some local governments require certificates confirming adherence to zoning, fire, and safety regulations.

Property tax clearance certificates prove all property taxes are paid before a property sale. You need this document to transfer ownership legally. Local tax authorities issue these certificates after verification of payment status.

To obtain your certificate, check your property tax records first. Look for any unpaid taxes or outstanding amounts that need clearing. Local regulations require full payment of all taxes before issuing clearance.

Pay all due amounts and keep recent payment receipts as proof. Submit your payment evidence to the local tax office for processing. The authority will verify your payments and issue the certificate. This document prevents future liability issues for both buyer and seller.

Proper documentation is vital when selling inherited property within an HOA. You must provide a property deed that matches HOA records. A Letter of Good Standing proves all dues are current and paid.

Rules and regulations disclosure helps buyers understand property limitations.

Transfer fees vary by HOA and must be communicated to all parties before closing. Local compliance certificates confirm the property meets zoning requirements and safety standards.

Always contact your specific HOA for their exact requirements. This preparation prevents closing delays and ensures a smooth ownership transfer. Most associations have standard forms available for sellers to complete.

Municipal compliance certificates confirm your property meets local regulations before selling it. You need several key documents for property transfers.

A Certificate of Occupancy validates that all renovations were properly permitted.

Environmental Compliance Certificates are required if your property has known environmental issues. Utility inspection reports show the property has no outstanding problems.

These certificates support your property transfer process. Local governments require this documentation to protect new buyers.

With proper compliance certificates, your property sale can proceed smoothly. Additionally, having these documents ready speeds up the closing timeline.

OR Home Buyers specializes in quick inherited property sales in Oregon. We simplify the entire process for you.

Our team manages all executor paperwork and creates property settlement agreements. We solve title problems and locate missing documents without hassle.

Most sales complete in just 10 days. No realtor fees or complicated legal procedures to worry about. The process starts with a free consultation about your inherited property situation.

You’ll receive a fair cash offer with flexible closing options. This approach lets you move forward without the typical stress of property sales.

Envision selling Grandma’s house; IRS rules let you use the stepped-up basis, so you pay taxes only on gains after her death. Report gains with IRS Form 8949 and Schedule D for accurate tax compliance.

You need the property deed to prove ownership, the title search to confirm clear ownership, and the sale agreement to outline terms. These documents ensure a smooth transaction, protect the buyer, and fulfill legal requirements efficiently.

You can avoid capital gains tax by selling within a year of death, living in the property for two of five years, or using the stepped-up basis. Consult a professional to optimize your tax strategies and help others.

You anchor the sale by filing a new deed with the county recorder, transferring ownership. Provide legal court documents, clear liens, settle taxes, and keep copies for your records, guiding others smoothly through the property’s journey.

Hi, I’m Bob Bash, founder of OR Home Buyers, serving the Oregon community since 2017. We provide full-service real estate solutions, specializing in cash purchases for both residential and commercial properties. I started this business to help our community navigate difficult real estate situations with professionalism, ethics, and compassion.

My goal is simple: to make every client feel relieved and happy when their real estate challenges are resolved. Helping people find solutions and peace of mind is what drives me every day.

Sell Your Oregon Home Quickly. Receive a fair cash offer within 24 hours. We buy homes as-is, including complex titles, estates, and foreclosures. No repairs, no fees, no stress. A simple solution for a fast, flexible closing.

590 Pearl St suite 317, Eugene, OR 97401

@ 2024 OR Home Buyers. All Right Reserved