Selling a home can be stressful, especially when unexpected issues appear. One of the biggest problems sellers face is dealing with liens. These legal claims can stop or delay your sale if you don’t address them.

Many homeowners don’t realize their property has liens until they try to sell. This can lead to last-minute surprises at closing. You might lose buyers or face extra costs to resolve these issues quickly.

The main types of liens that affect a home sale are mortgage, tax, mechanic’s, and HOA liens. The good news is you can identify and resolve liens before listing your home.

Taking early action helps ensure a smooth sale. This blog will guide you through the steps to handle liens and protect your home sale.

A lien is a legal claim against your property. It usually acts as security for a debt you owe. If you do not pay, the lienholder can force a sale to recover their money.

Liens can affect your rights as a homeowner. Not all liens are the same, and some have higher priority than others. Foreclosure triggers and timelines can influence how and when liens are enforced during a home sale. If a property is sold, the highest priority liens get paid first.

Knowing about liens helps protect your ownership. If you understand how liens work, you can make better decisions in real estate deals. This knowledge can also help you avoid surprises during transactions. In Oregon, property disclosure statements are required by law and must include information about any existing liens on the home.

When you finance a home purchase, the lender secures its interest through a mortgage lien, which holds legal priority over most other claims. This lien directly affects your closing process, since it must be satisfied before ownership transfers to a buyer. You’ll need to follow a precise payoff and release procedure to ensure the lien is properly removed from the property title.

If your mortgage is assumable, the buyer may be able to take over your existing loan and its terms, but lender approval and specific steps are required for the transfer. It’s important to be aware that unresolved mortgage liens may impact capital gains tax calculations if the property is held in a trust, making accurate documentation and timely lien releases essential.

A mortgage lien is a legal claim the lender has on your home. If you take out a mortgage, the lender files this lien. The lien remains until you fully repay your loan.

The lien is recorded in public records and linked to your property title. If you want to sell your home, you must pay off the mortgage first. This ensures the new owner gets clear ownership.

Mortgage liens usually have priority over most other claims on the property. If you stop paying the loan, the lender can take your home. Understanding this legal status helps protect your investment.

A mortgage lien directly affects the home closing process. It must be paid off before the sale can be completed. If the lien is not resolved, the closing cannot move forward.

Settlement agents use the sale proceeds to pay off any active mortgage liens. The lender receives payment first before the seller gets any money. If a lien remains, the buyer cannot get clear ownership.

Buyers and their lenders need to know the property is free of liens. If all liens are not settled, the deal might be delayed or cancelled. Sellers should address liens early to avoid closing problems.

Removing a mortgage lien is needed to give the buyer a clear title. The seller must pay off the mortgage before the sale is complete. If you do not remove the lien, the sale cannot close.

You should ask your lender for a mortgage payoff statement. This statement will show the total amount you owe. An escrow or closing agent can help pay the lender from the sale funds. The lender must receive this payment in full.

Once paid, the lender should send you a release of lien or satisfaction of mortgage. If you do not get this document, the lien stays on the property. You must record the release with the county recorder’s office. Only then is the title officially clear.

You’ll need to understand how an IRS tax lien can severely impact your property’s title and your credit profile. Each state enforces a unique process for recording and enforcing tax liens, which can complicate your ability to sell or refinance. In Oregon, for example, estate taxes for properties valued over $1 million can also play a role in the legal and financial considerations surrounding property liens.

Clearing these liens requires strict compliance with repayment terms and formal release documentation to restore clear ownership. Addressing tax liens promptly is crucial to maintain buyer confidence and ensure your Oregon home sale proceeds without delays.

An IRS tax lien is a legal claim against your property for unpaid federal taxes. This lien can lower your home’s value and make selling harder. You must deal with the lien before any sale can close.

IRS liens come before most later liens but not always earlier mortgages. Title insurance companies often refuse coverage if a lien exists. Without title insurance, buyers and lenders may lose interest in your home.

A tax lien makes your title unclear, which discourages buyers. Sometimes, the lien is larger than your home’s equity. If you want to sell, you usually need to pay the IRS or work out a deal with them.

A state tax lien reduces your control over your property. It makes it hard to sell or refinance your home. Buyers and lenders often avoid properties with unresolved tax liens.

The state files the lien in public records. This recording lowers your property’s value and deters interested buyers. Title insurance companies may refuse coverage if a lien exists.

If you want to sell, you must resolve the lien first. Removing the lien will clear your title. This step improves your property’s marketability and value.

To clear a tax lien from your home’s title, you must pay off or settle the debt. Tax liens are public records and often have priority over other claims. Removing the lien restores your property’s clear title.

You should first request a written payoff amount from the tax authority. Property value can affect how much you need to pay. If your home has little equity, the IRS or state may accept less than the full amount.

After paying or settling, ask for a lien release document. Submit the release to your county recorder’s office. Always check that the lien is removed from public records.

Mechanic’s liens are legal claims against your property when you do not pay contractors or suppliers. These liens attach to your home and can make selling it difficult. In Oregon, foundation issues can also complicate real estate transactions if mechanic’s liens are present for repair work. You must address mechanic’s liens before you can transfer a clear title.

A mechanic’s lien can sometimes take priority over other debts, even mortgages, depending on local laws. If work started or materials arrived before a mortgage, the lien may come first. This can affect the order debts are paid if the property is sold.

To avoid problems, always pay contractors in full when the job is done. Property owners should ask for lien waivers after payment. If you have unpaid liens, resolve them before any sale to avoid legal trouble.

Mechanic’s liens are one of several types of liens that can impact the sale process and must be addressed to ensure a smooth transaction.

An HOA lien is a legal claim the association places on your property if you do not pay your dues. This lien becomes public record and must be paid before you can sell your home. If you do not resolve it, the HOA may start foreclosure.

The lien attaches automatically as soon as dues go unpaid. It can take priority over some other debts or liens. Title companies will not insure your property until the lien is paid in full. In Salem real estate transactions, unresolved HOA liens can delay closings and complicate the overall selling process.

If you are planning to sell your home, check your HOA account first. Any unpaid balance will need to be settled before closing. If you wait too long, you may risk losing your property to foreclosure. If your property is also affected by property condition issues, you may need to address those alongside the HOA lien to ensure a smooth sale.

When a court awards a creditor a money judgment against you, they can record a judgment lien that attaches to your real property, clouding your title. You’ll need to address this encumbrance before selling or refinancing, typically through satisfaction, settlement, or a legal motion to release the lien. Understanding the attachment process and removal options is crucial to protect your ownership rights.

In Oregon, it’s especially important to resolve any judgment liens because clear proof of ownership is required prior to selling property, whether or not probate is involved. Since Oregon follows equitable distribution rather than a strict 50/50 split in divorce property division, resolving liens efficiently can help ensure a fair and smooth sale of your home.

A judgment lien attaches to a property after a court rules that the homeowner owes money. The creditor must record the judgment with the county. Once recorded, the lien sticks to any real estate owned in that county.

This lien can lower the property’s value because it makes the title unclear. Buyers and lenders often want clear titles before closing a sale. The lien must be paid or dealt with before the property can be sold.

Lien priority decides the order in which debts are paid if the property sells. Judgment liens are usually paid after taxes and mortgages. If other claims exist, those filed earlier will be paid first.

You can remove a judgment lien from your home’s title using several legal options. First, confirm the lien is valid and the debt amount is correct. This helps you know your next steps.

If you owe the debt, try to negotiate a settlement with the creditor. Sometimes, creditors accept less if your home’s value is low. You may pay the lien in full to clear your title.

If you have little equity, you might file a court motion to reduce or release the lien. Courts may remove lower-priority liens before higher ones. Always check your local laws first.

Bankruptcy sometimes removes judgment liens, but this depends on your state and situation. Not all liens qualify for removal in bankruptcy. Ask a real estate lawyer if this applies to you.

You should always consult a real estate attorney before selling your home. They can guide you and help ensure your title is clear. This protects you during the sale process.

A child support lien limits your property rights. The state can place a lien on your real estate if you owe child support. You cannot sell or refinance your property until you pay the overdue amount. Owing child support can lead to a state lien on your property, blocking any sale or refinance until the debt is paid.

Child support liens attach when unpaid support exists. These liens stay until you pay or settle the debt fully. Title companies will not insure the sale unless the lien is released. In Oregon, sellers facing a child support lien should consider cost-effective home improvements to increase property value and offset the financial burden of the lien.

If you try to sell your home, the lien must be paid from the money you get. The lien can also lead to wage garnishment or even a forced sale. Interest may add to the total amount you owe.

Buyers and lenders often avoid properties with child support liens. These liens are considered serious risks. If you have a lien, you should resolve it quickly to protect your property rights.

In Oregon, disclosure requirements also mean you must inform potential buyers about any existing child support liens to ensure transparency and avoid legal complications during the sale.

You’ll encounter utility liens when unpaid balances for services like water, electricity, or sewer accumulate against your property. These liens typically originate from municipal providers and can impede a sale or refinancing until resolved. To clear a utility lien, you must satisfy outstanding bills and obtain a formal lien release from the utility authority. In Creswell, utility liens are one of the challenges such as liens that may need to be addressed before you can sell your house for cash.

A utility lien happens when homeowners do not pay for municipal services like water, sewer, electricity, or gas. The utility company or local government can place a claim on the property for the unpaid amount. This lien must be settled before the property can be sold.

Utility liens can affect the property’s value because they create an additional debt. Some areas treat these liens as “super liens,” which means they may take priority over other debts. Title insurance underwriters must check for these liens to ensure the title is clear.

Common sources of utility liens include unpaid water and sewer bills. Other sources are overdue trash collection, recycling fees, or stormwater management charges. Delinquent electricity and gas bills can also lead to utility liens.

When a utility lien is on a property, you must resolve it quickly to protect your ownership rights. Utility liens come from unpaid bills and can delay property sales. Clearing the lien ensures a smooth real estate transaction.

Start by contacting the utility company for a statement showing what you owe. If the amount seems wrong, gather documents and formally dispute the lien. Supporting paperwork can help your case during the dispute process.

Pay the outstanding bill or resolve the dispute as soon as possible. After payment or resolution, request a lien release document from the utility provider. File this document with your county office to clear your property title.

Income tax liens are claims placed on your home by the IRS or state if you do not pay your taxes. These liens attach to your property and make selling it more difficult. A tax lien usually takes priority over other debts on the home.

If you try to sell your home with a tax lien, buyers may insist on clearing the lien first. Title insurance companies will find the lien during their search. They usually require you to pay off the lien before closing the sale.

Title insurance will not protect against income tax liens if they are not resolved. Sale proceeds may be used to pay off the lien at closing. Lien amounts can grow over time because they add interest.

A vendee’s lien protects buyers if sellers do not deliver a clear title after payment. This lien lets you claim back the money you already paid. If the sale fails, you can use the lien to recover your investment.

The lien attaches to the property and can affect its sale. It usually has priority over later claims but not over earlier mortgages. Knowing about vendee’s liens helps you protect your money in real estate deals.

Municipal liens are claims that a local government places on a property when the owner fails to pay certain bills. These can include unpaid property taxes, utility bills, or code enforcement fines. The lien stays with the property until it is paid.

If a property has a municipal lien, it can reduce the value and make it harder to sell. Buyers and lenders see these liens as serious risks. Title insurance companies will not issue a policy until all municipal liens are cleared.

Tax delinquencies can quickly result in these liens. Unpaid utility charges and code violations may also lead to recorded liens. Anyone selling or buying property should check for municipal liens early.

A lis pendens is a public notice that a lawsuit may affect the ownership of a property. This warning tells buyers and lenders about ongoing legal issues tied to the real estate. If a lis pendens exists, selling the property becomes much harder.

Most buyers avoid properties with a lis pendens because of legal risks. Title insurance companies usually will not provide coverage for these properties. Lenders often refuse to approve loans until the legal matter is settled.

If a lis pendens is recorded, property value can drop due to the uncertainty. The sale process may be delayed until the lawsuit ends. Negotiations become more difficult, and closing is often postponed.

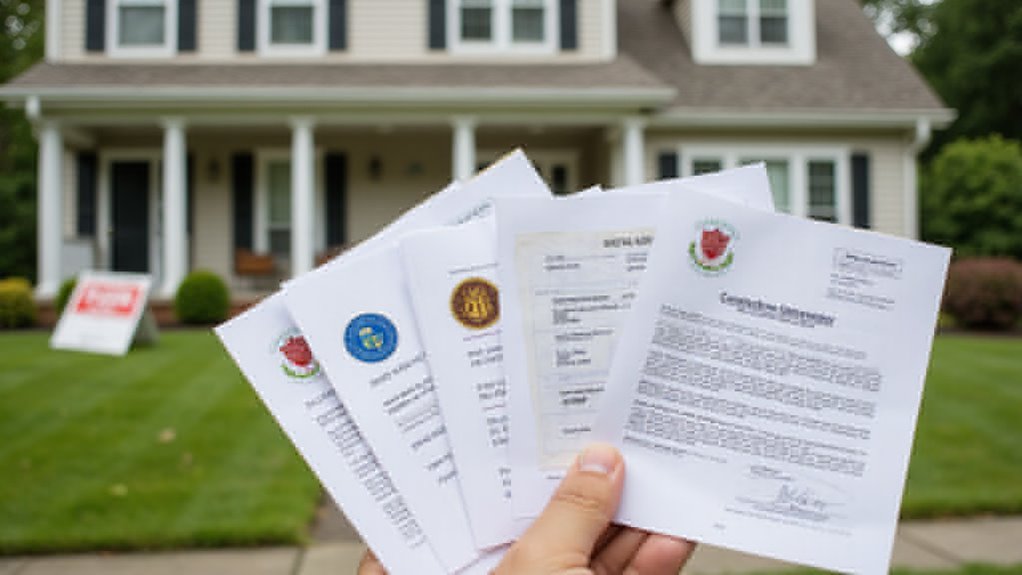

Liens are found during the selling process with a title search. The title company or your attorney checks public records for any claims. These checks help identify issues that could delay or stop the sale.

A title search finds recorded liens, such as tax or judgment liens. Title insurance companies use these results to assess risks. If you have city debts, a lien certificate shows them.

Public records may reveal legal actions like a lis pendens. Mortgage payoff statements are reviewed to make sure all liens are released. If any problems appear, they must be fixed before the sale can close.

You can remove or resolve liens before closing by following clear steps. Start by asking the lienholder for a payoff statement. This statement shows the exact amount you must pay to clear the lien.

Check if your home’s value is up to date because this can affect negotiations. Contact the lienholder to discuss payment options. If you are selling, you might use the sale money to pay off the lien at closing.

Work with your escrow officer to make sure all liens are paid off before the sale finishes. Title insurance can protect both the buyer and lender from hidden liens. After payment, request a release of lien document and ensure it is recorded with the county.

If you want to sell your home quickly, you should address any liens or title issues before listing. When homeowners clear up mortgage, tax, or other liens, they help avoid delays at closing. If you resolve these problems early, your sale process will be much smoother.

If you have a lien and need to sell fast, we buy houses for cash in any condition. We can help even if there are title or lien issues. If you want a quick and hassle-free sale, we are ready to assist.

If you want to learn more, contact us today at OR Home Buyers. We can answer your questions and give you a fair cash offer. Let us help you sell your home with confidence.

Hi, I’m Bob Bash, founder of OR Home Buyers, serving the Oregon community since 2017. We provide full-service real estate solutions, specializing in cash purchases for both residential and commercial properties. I started this business to help our community navigate difficult real estate situations with professionalism, ethics, and compassion.

My goal is simple: to make every client feel relieved and happy when their real estate challenges are resolved. Helping people find solutions and peace of mind is what drives me every day.

Sell Your Oregon Home Quickly. Receive a fair cash offer within 24 hours. We buy homes as-is, including complex titles, estates, and foreclosures. No repairs, no fees, no stress. A simple solution for a fast, flexible closing.

590 Pearl St suite 317, Eugene, OR 97401

@ 2024 OR Home Buyers. All Right Reserved